Learn more about California's new minimum auto insurance requirements.

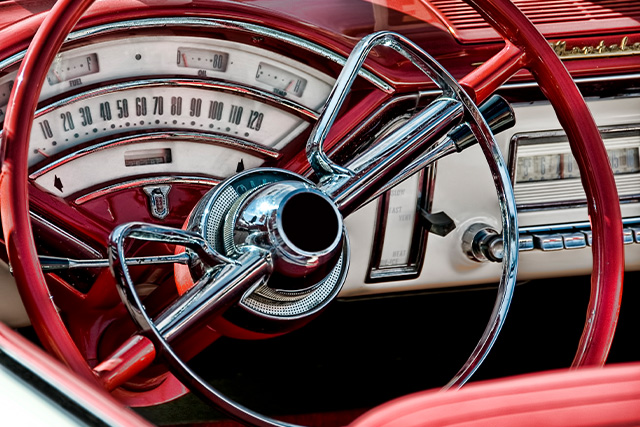

A Special Car Deserves Special Coverage

Your classic car is more than just another vehicle—it's a cherished piece of history and a valuable investment. At AIS, we understand that a standard auto insurance policy does not meet the unique needs of classic car owners. To help protect your timeless vehicle, AIS partners with Hagerty to offer personalized California classic car insurance policies with essential coverage, exclusive savings, and valuable customer service.

What is Classic Car Insurance in California?

Classic car insurance in California is designed specifically for vintage and collectible vehicles, offering coverage options that standard auto insurance can't match.

Since classic cars can increase and vary in value, these policies typically follow an agreed-value approach, which allows owners and insurers to assign an "agreed value" to the vehicle at the time of writing. Your insurer will compensate you for the agreed value amount if you suffer a loss depending on your policy.

What is Considered a Classic Car?

Though definitions and requirements vary, most cars are considered classic when they reach 25 to 30 years old. To qualify for coverage, your vehicle typically must:

- Have limited use: classic cars cannot be daily drivers.

- Maintain or appreciate value: Classic cars do not usually depreciate like standard vehicles.

- Be properly stored: most insurers require covered storage for classic cars.

How to Get Classic Car Insurance in California

AIS partners with Hagerty Insurance to offer personalized coverage for classic, kit, and antique cars. We understand the needs of classic car owners, making it simple to purchase California classic car insurance policies in just a few simple steps:

- Provide zip code, garaging, and contact information.

- Share details about your classic car's make, model, annual mileage, and customizations.

- Set your classic car's value.

- Purchase your policy and enjoy peace of mind.

Ready to get covered? Click the link below to start your quote with AIS and Hagerty today.

Commonly Asked Questions about California Classic Car Insurance

Classic car insurance is a type of coverage designed to protect antique and classic cars through liability, comprehensive, collision, and additional specialized coverages. Unlike standard auto insurance policies, these policies are customized to match your car’s value and build. Coverage limits are typically based on the agreed-upon value of your vehicle, which you set with your insurer.

Classic car insurance coverages are similar to those on a standard auto policy. Typical coverages include liability, comprehensive, collision, uninsured motorist, and medical coverages such as personal injury protection (PIP). You can also add further coverages to your policy, including roadside assistance.

To purchase classic car insurance in California, you must meet the following requirements:

- Vehicle's age: Most insurers require vehicles to be at least 25 years old to be considered classic cars, but some may have stricter requirements.

- Usage: Classic cars cannot be used as daily or primary vehicles. Their use is typically limited to car shows, exhibitions, and pleasure driving.

- Storage: Classic cars must be stored in a secure, covered structure, such as a garage or storage unit, to be insured.

- Additional vehicle: You must own an additional vehicle as your primary car and have a standard auto policy.

- Driving history: Drivers cannot have serious driving violations on their record to purchase a classic car policy.

If your vintage car does not meet these requirements, you can still purchase a traditional auto insurance policy.

You must purchase classic car insurance if you own a classic car. Auto insurance is legally required in most states, so you must at least carry your state's required liability insurance limits to drive your vehicle on the road. You can risk fines or your license suspension if caught driving without insurance. Apart from the legal requirements, having classic car insurance will protect your investments if your car is damaged.

Although classic car insurance sounds similar to a traditional auto policy, the two have a few key differences:

- Agreed value policy: Because collector cars can appreciate despite age, classic car policies follow an agreed value approach. This means you base your insurance limits on an agreed-upon value of the vehicle between you and the insurer. In the event of a loss, you’d receive a payout based on this agreed value, depending on your coverage types. On the other hand, standard auto policies are based on the vehicle’s actual cash value, which factors in depreciation.

- Usage: Classic car insurance is intended for collector cars that are driven occasionally, not as primary vehicles. Under a classic car policy, your classic car cannot be your primary mode of transportation.

- Storage requirements: Many classic car insurers will require that you store the vehicle in a secure, enclosed space.

- Lower premiums: Since classic cars are driven less than primary vehicles, classic car policies typically have lower premiums than traditional auto insurance rates.

Since classic car insurance is tailored for priceless cars, each policy and premium will vary greatly from one driver to the next. Your classic car premium will be based on specific factors, such as:

- Vehicle's value: The more expensive your car is, the higher your premium will be.

- Coverage: The amount of available coverages you add to your policy can significantly affect your rates.

- Mileage: How often you use your classic car will affect your insurance premium.

Classic car insurance will cover vehicle theft if you carry comprehensive coverage. Comprehensive coverage protects against theft, vandalism, and other non-collision events, such as damage caused by fire or other natural events. The amount you receive through your comprehensive claim will depend on your vehicle's agreed value minus your deductible.

AIS California Insurance Coverages

We offer California customers more than Auto Insurance coverage. Wouldn’t it be great to save money insuring your automobile, home, condo, or renters policy with your outdoor vehicles and other assets under one roof? AIS is the insurance specialist that will find affordable coverage for a range of assets. We compare the best rates from our trusted carrier partners, so you know you’re getting the best protection for the best price at no additional charge.